Open banking is now an integral part of many business models and is often equated with access to account transaction data.

At fino, we know: open banking is much more than just access to account!

With our open banking modules, we combine Access to Account with intelligent, modular Data Analytics solutions. Our AI-based open banking modules can be put together according to the modular principle and provide you and your customers with exactly the information that will help you advance your project – customized, modular, connecting the dots!

We have taken access to account further for you: With our open banking modules, we combine PSD2-compliant access to account transaction data with pioneering data analytics solutions. In fact, almost the entire life of customers is reflected in transaction data. Income, expenses, living and housing situations, as well as credit, liquidity, loans, and contracts of all kinds, describe the customer’s world in detail and are relevant information for tailoring products, services, and customer experiences even better to needs.

The intelligent linking and analysis of data sets delivers relevant insights that create new perspectives for your business model and guarantee added value for you and your customers.

And to ensure that you get exactly the information you need for your project, our data analytics modules can be tailored to your use case. Our AI-based modules navigate you through the data jungle so that you have more time for the essentials!

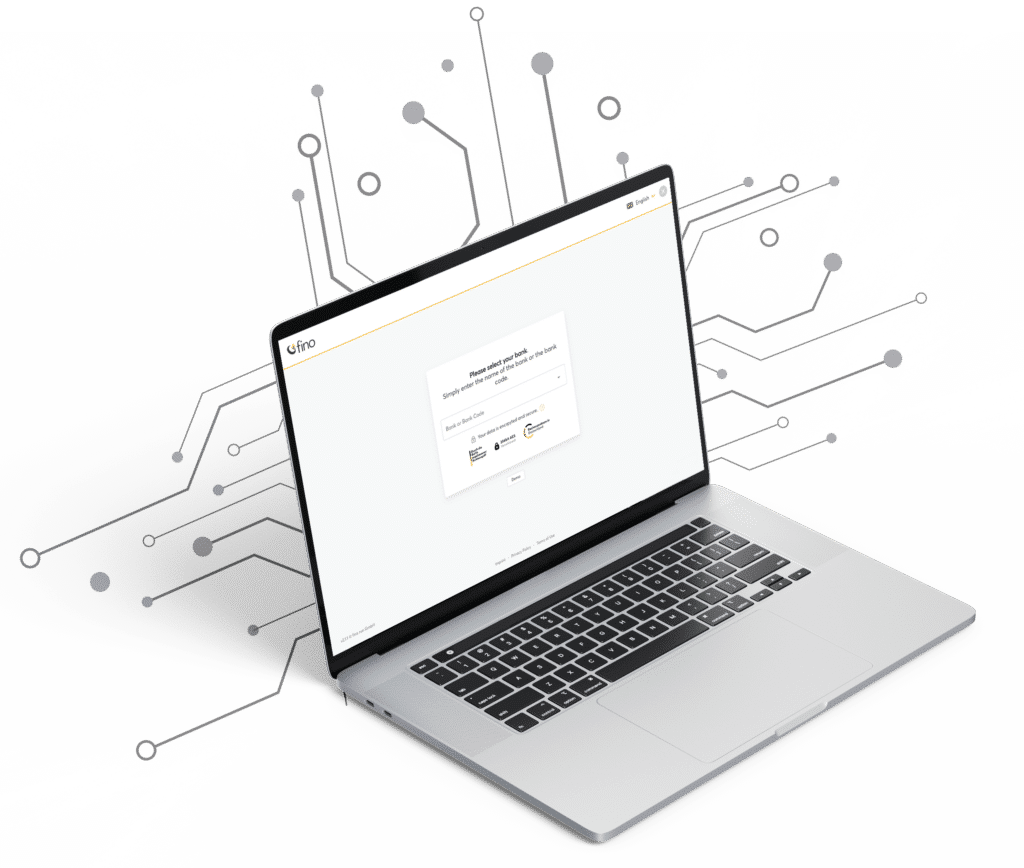

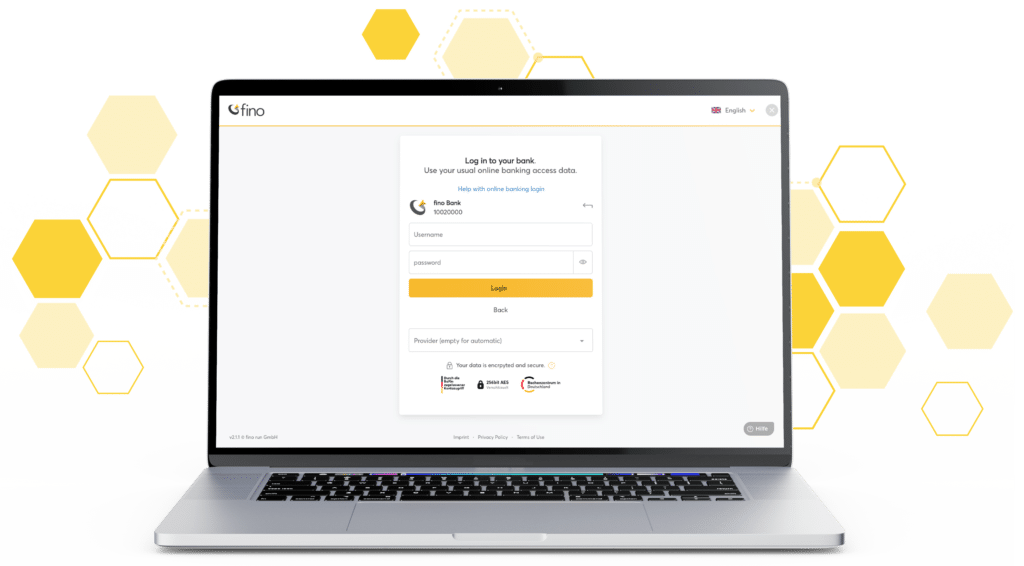

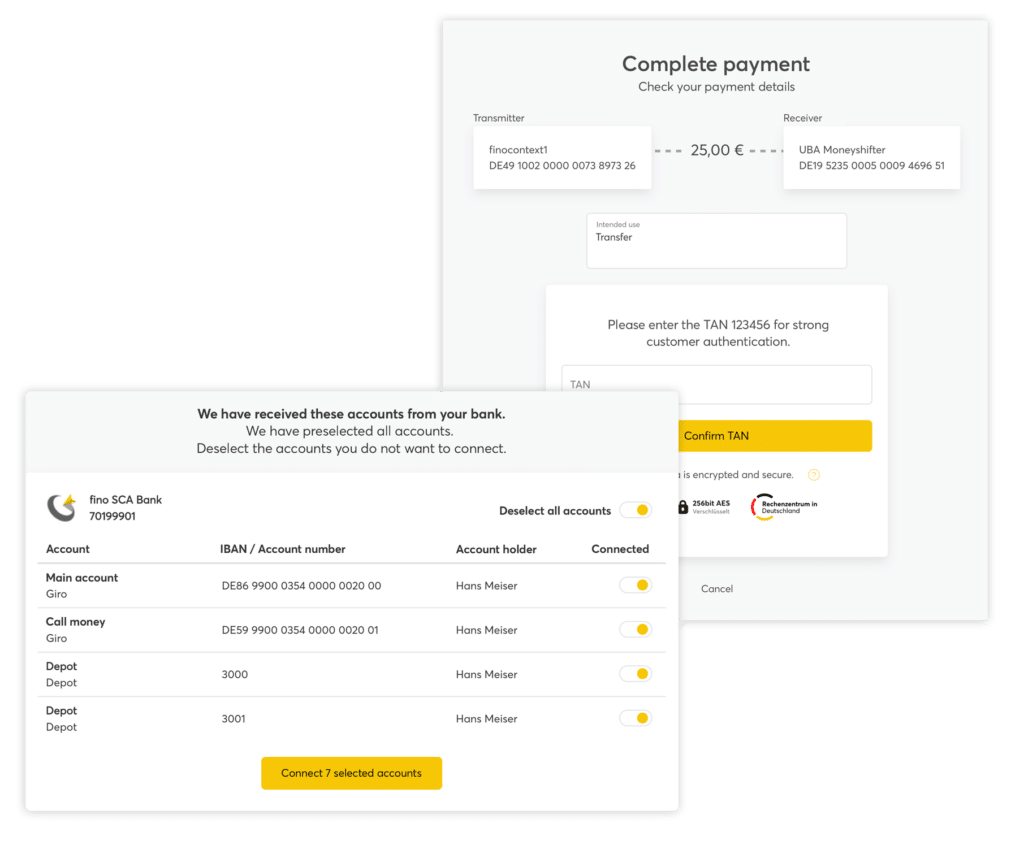

Our Access to Account interface (XS2A) gives you secure access to personal and business account data in seconds on behalf of your customers.

Use our open banking modules to turn account data into valuable knowledge. Simply combine the appropriate analytics for your use case according to the modular principle!

No matter whether private or business accounts, current accounts, credit card accounts or securities accounts. Our banking API connects all account types - even multiple accounts at the same time!

fino is a BaFin-certified account information and payment initiation service provider (AISP/PISP). Our open banking modules comply with the strict PSD2 directive.

Our data analytics modules are subject to the highest German IT security standards and are hosted in German data centers - Made & hosted in Germany!

With the open banking modules, you always get the right account and data analysis solutions for your use case. Simply combine access to account with other data analytics building blocks, such as categorization of account transactions, contract detection or pre-packaged analytics services such as budget calculator, account history, liquidity, life situation and many more.

In real time, our open banking modules evaluate, among other things, income levels, existing contracts or so-called life-changing moments, which reveal new sales potential.

Or you can use our data analysis modules for digital credit checks and application processes – speeding up credit decisions, for example, and thus increasing customer satisfaction. The possibilities and use cases are endless.

How can open banking modules take your business model to the next level? We would be happy to advise you!

“We believe that employees in Germany should have the right to access their earned salary at any time. With MyWage we have founded a start-up that offers employees the opportunity to receive a salary advance discreetly and without stress, regardless of payday. Using fino’s open banking modules, we obtain account access and use the account data to identify, among other things, the salary and employer as the basis for the salary advance. With fino’s Access to Account, we have chosen a PSD2-compliant open banking solution that integrates seamlessly with our product as a white label solution, is user-friendly and meets the highest security requirements.”

Founder of MyWage

With Licence as a Service from fino, you can use banking technologies in compliance with the strict PSD2 guidelines even without your own BaFin-license. This allows you to fully concentrate on your core business - Europe-wide!