With our PSD2-compliant access to account technology (XS2A), you get access to your private or business customers’ account transaction data after they have given their consent. You don’t even need your own PSD2 license for this – because with fino as a BaFin-licensed service provider, you are completely protected from a regulatory point of view!

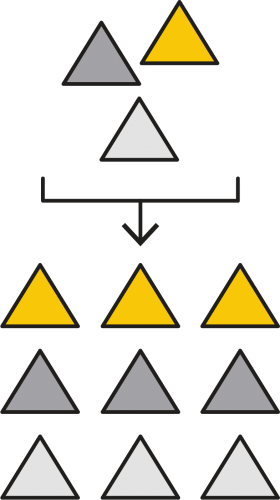

Our banking API gives you access to various account types, such as current accounts, credit card accounts or securities accounts. Even connecting multiple accounts simultaneously is child’s play for your customers via the user-friendly front end. And the best thing for you: As a white label solution, the open banking application can be quickly and seamlessly integrated into your systems! And if you like things even more clearly laid out, you can either book additional modules or visualize the data records with company logos of all payment partners.

With our open banking “Categorization” module, the multitude of data records from access to account can be made usable for you even faster. By tagging the account transactions, they are enriched with information such as income or expenditure, type of transaction (e.g. food, rental income, energy supply, etc.), interval of recurring transactions and other characteristics. Categorization provides you with clearly organized transaction data for fast further processing. Simply book the categorization module with access to account and save yourself the time-consuming manual evaluation of the data records.

Our intelligent data analytics solution “Contract Detection” is able to filter out recurring transactions by type and amount from a large number of account transactions and identify and mark them as existing contracts.

Clearly arranged according to contract categories, you can recognize loans and credits, financial investments, insurance contracts, subscriptions and memberships, energy supply and much more at a glance.

The visualization of the contracts with the corresponding company logos of the contractual partners provides even more clarity.Score points even with new customers right from the start with tailored consulting offers and derive sales impulses, such as pension gaps, in real time!

With our “Analysis Services”, we provide you with intelligent data analytics packages that are suitable for many use cases. For example, we prepare information on current income and expenses for you in a “Budget Calculator” that shows surpluses or deficits at a glance. Combined with the “Account History” analysis service, you also receive a graphical presentation of the account history, which gives you a quick insight into the financial situation over time.With the combination of access to account and our “Document Retrieval” analysis service, you match account transactions with the associated invoices and contracts. Our intelligent document retrieval not only recognizes transactions but also automatically assigns the correct invoice and contract documents to the account transactions.

Or you can learn more about your customer’s personal circumstances (e.g. marital status, children, living situation, etc.), liquidity, or the breakdown of monthly expenses across different categories such as food, clothing, mobility, vacations, and more. The analysis services provide you with valuable insights into your customer’s world – simply at the touch of a button.

We would be happy to advise you on the right analysis services for your use case!

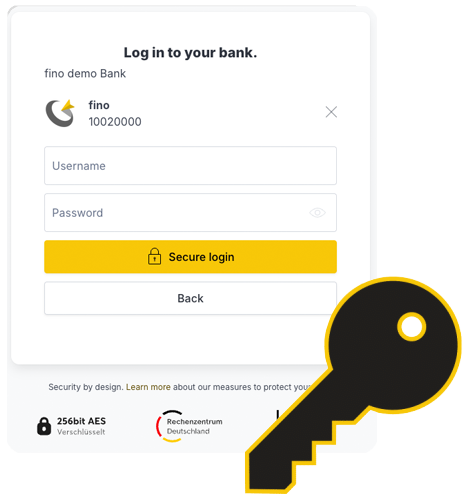

As a BaFin-licensed payment initiation service provider (PISP), our open banking module “Payments” helps you make bill payment as easy as possible for your customers – whether it’s a simple SEPA transfer, a collective transfer, or a scheduled transfer.

Via our intuitive frontend, your customer logs into his online banking easily and securely and only has to check and approve the payment transaction. This way, you relieve your customer of the time-consuming task of filling in the payee, IBAN, amount or reason for payment and enable fully automated payment initiation directly in the billing process.

And the best thing for you: We check for you whether the transfer was executed correctly and inform you about the successful transaction!