Analytics for every business

USE CASES

The type and number of use cases that benefit from the tailored analysis of account transaction data is almost unlimited. We have compiled a few possible use cases for you here that can be mapped quickly and easily from the combination of our data analytics modules.

Haven’t found the right fit yet?

Get in touch with us: Together we will find the perfect solution for your business model!

Precise customer consulting

Sales impulses

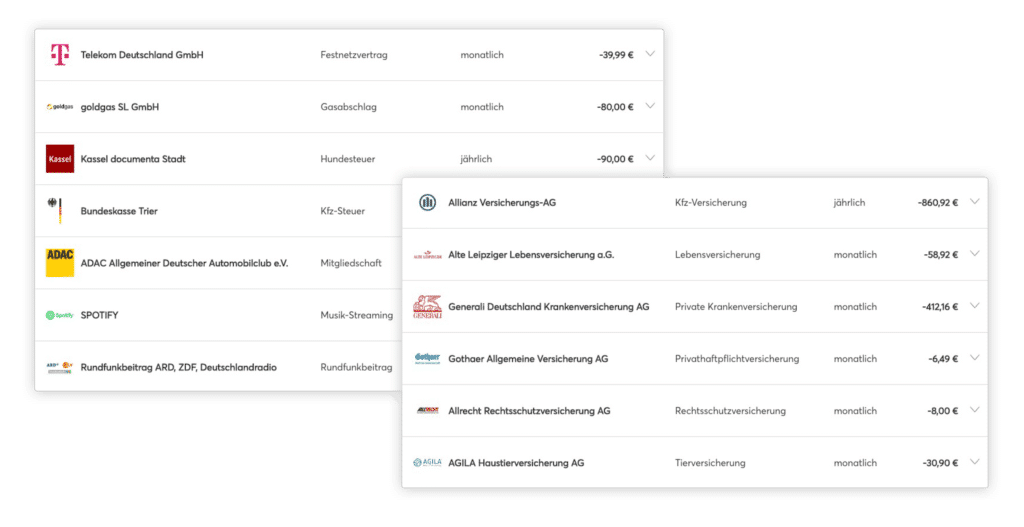

With the help of access to account and the open banking module Contract Detection, you can even identify existing financial and insurance contracts for new customers at first glance and receive valuable sales impulses as recommendations for action.

In this way, you can score points with your new customers from the very first moment with products and services tailored to their needs or accurately identify new sales opportunities with existing customers through life changing moments!

Minimize risks

CREDIT CHECK & RISK ANALYSIS

Use our access to account and categorization modules in combination with our liquidity and income/expense reconciliation analysis services to get to know your customers better for new business relationships. The flagged income and expenses, as well as monthly deficits or surpluses, quickly give you a good insight into your customer’s financial situation. This makes credit checks, risk analyses or even budget-compliant product offers child’s play.

Improve customer experience

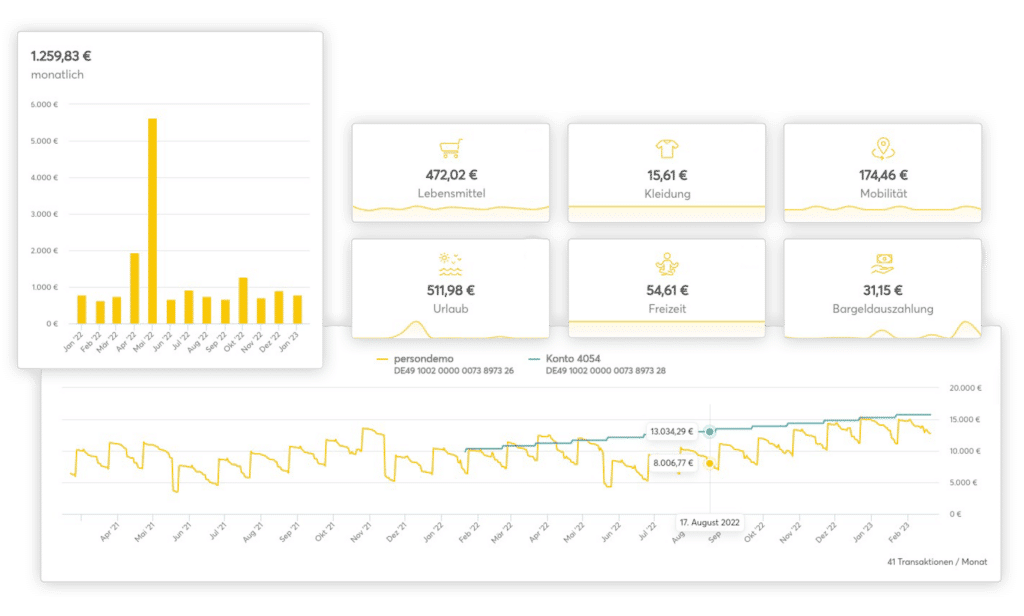

DIGITAL FINANCE CHECK

Would you like to impress your customers with an improved customer experience? That’s no problem either: In times of rising living costs and energy prices, give your customers a digital financial check at the touch of a button. Clearly presented according to income and expenses, cost types, current contracts and graphical account history, your customer will keep his costs safely under control and additionally benefit from possible savings potentials through your alternative product suggestions.

Account transactions & document retrieval

INVOICE AND TRANSACTION MATCHING

With the combination of access to account and our “document retrieval” analytics service, you match account transactions with the associated invoices. Our data analytics solutions feature intelligent document retrieval that not only recognizes transactions, but also assigns the account transactions to the correct invoice documents or contracts immediately and fully automatically – so you always have all the relevant information on the payment transactions at your fingertips.

Automatic linking not only saves you valuable time, but also the effort of manual research and investigation.

Incoming payments at a glance

RECEIVABLES MANAGEMENT

Simply log into your business account via the open banking modules and check clearly categorized and in real time whether you have received any outstanding receivables. In the event of a payment delay, we will be happy to digitally send a payment reminder for you.

In order to provide your customers with the best possible support in the event of payment difficulties, we also offer a quick check of the liquidity and income & expenses of your private or business customers with our analysis services. To do this, simply send your customer a personalized and secure account login link and our AI-based data analytics software will do the rest.

Based on the analysis result, you can conveniently offer your customer the appropriate payment option, e.g. installment payment, without any risk.

Rental income & expenses

RENTAL

For landlords of multiple properties, it’s often tedious to keep track of everything: Have rent payments been received on time or is a tenant in default?

Have utility bills been paid on time? Here, too, fino’s open banking modules make life easier for you and enable smart rental income management.

Simply combine access to account with the “Categorization” module and get a detailed overview of receipts at the touch of a button.

By adding the modules “Contract Detection” and “Document Retrieval”, it is also possible to recognize one-off or recurring expenses, such as tradesmen’s invoices, and match them immediately with the appropriate invoices –simple, time-saving and fully automatic!