Added value through data analytics

Open Banking: More than just Access to Account

Whether it’s open banking, banking API, XS2A (access to account), PSD2 – many terms describe the same state of the art technology: access to account transaction data.

At fino, we have rethought account access and add value to account data through our innovative, AI-based data analytics solutions and services. Our open banking modules deliver precisely tailored analyzed information that moves your business model forward – modular, customized and with guaranteed added value!

Analyze & use account data

Open Banking Modules

With the implementation of the Payment Service Directive 2 (PSD2), the closed financial world evolved into a customer-centric ecosystem that enabled innovative customer experiences under the keyword “open banking”. Today, open banking and the access to account transaction data it describes have become an integral part of many business models. In fact, almost the entire life of customers is reflected in their transaction data, creating new perspectives for customer-centric products and services.

But for us at fino, access to account is just the first step: to turn data into knowledge, we combine access to account with pioneering data analytics technologies that link individual data points to create real value. Depending on the use case or business model, our AI-based open banking modules can be put together according to the modular principle and provide you and your customers with exactly the information and insights that will help you advance your project – customized, modular, connecting the dots!

Would you like to know more?

Just give us a call or write to us. We look forward to getting to know you!

Take off with open banking

We Are the API Experts at Your Side

Fast data retrieval

Our Access to Account interface (XS2A) gives you secure access to personal and business account data in seconds on behalf of your customers.

Analyze account data

Use our open banking modules to turn account data into valuable knowledge. Simply combine the appropriate analytics for your use case according to the modular principle!

Connect multiple accounts

No matter whether private or business accounts, current accounts, credit card accounts or securities accounts. Our banking API connects all account types - even multiple accounts at the same time!

PSD2 compliant

fino is a BaFin-certified account information and payment initiation service provider (AISP/PISP). Our open banking modules comply with the strict PSD2 directive.

Highest security

Our data analytics modules are subject to the highest German IT security standards and are hosted in German data centers - Made & hosted in Germany!

Modules at a Glance

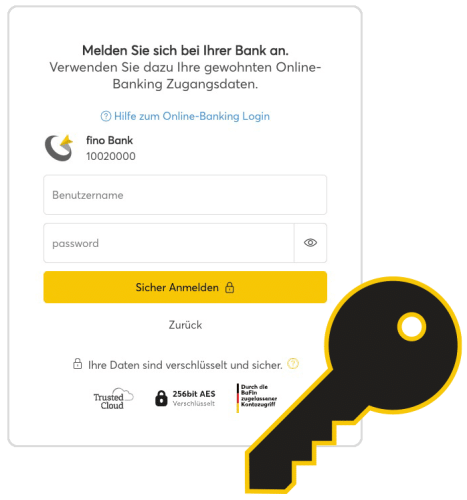

XS2A - Intuitive & secure

Access to Account

With our PSD2-compliant access to account technology (XS2A), you get access to your private or business customers’ account transaction data after they have given their consent. You don’t even need your own PSD2 license for this – because with fino as a BaFin-licensed service provider, you are completely protected from a regulatory point of view!

Our banking API gives you access to various account types, such as current accounts, credit card accounts or securities accounts. Even connecting multiple accounts simultaneously is child’s play for your customers via the user-friendly front end. And the best thing for you: As a white label solution, the open banking application can be quickly and seamlessly integrated into your systems! And if you like things even more clearly laid out, you can either book additional modules or visualize the data records with company logos of all payment partners.

Sort account transactions instantly

Categorization

With our open banking “Categorization” module, the multitude of data records from access to account can be made usable for you even faster. By tagging the account transactions, they are enriched with information such as income or expenditure, type of transaction (e.g. food, rental income, energy supply, etc.), interval of recurring transactions and other characteristics. Categorization provides you with clearly organized transaction data for fast further processing. Simply book the categorization module with access to account and save yourself the time-consuming manual evaluation of the data records.

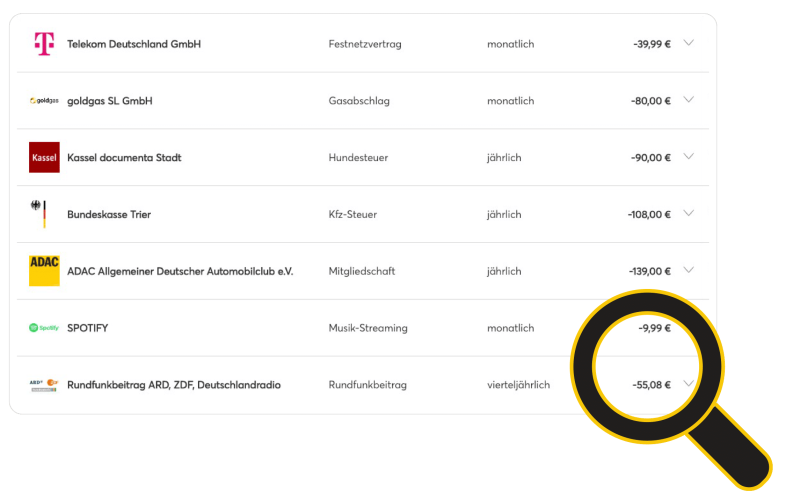

Detect contracts in account data

Contract Detection

Our intelligent data analytics solution “Contract Detection” is able to filter out recurring transactions by type and amount from a large number of account transactions and identify and mark them as existing contracts.

Clearly arranged according to contract categories, you can recognize loans and credits, financial investments, insurance contracts, subscriptions and memberships, energy supply and much more at a glance.

The visualization of the contracts with the corresponding company logos of the contractual partners provides even more clarity.Score points even with new customers right from the start with tailored consulting offers and derive sales impulses, such as pension gaps, in real time!

Data Intelligence Packages

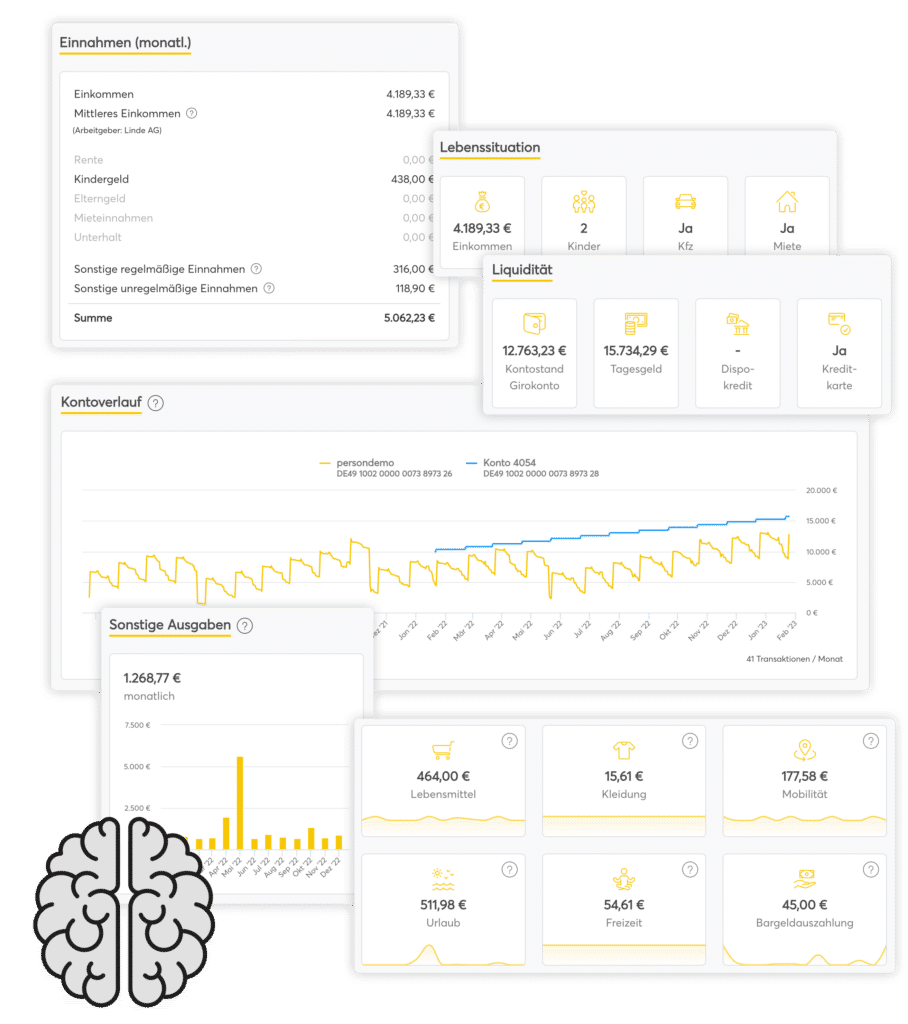

Analysis Services

With our “Analysis Services”, we provide you with intelligent data analytics packages that are suitable for many use cases. For example, we prepare information on current income and expenses for you in a “Budget Calculator” that shows surpluses or deficits at a glance. Combined with the “Account History” analysis service, you also receive a graphical presentation of the account history, which gives you a quick insight into the financial situation over time.With the combination of access to account and our “Document Retrieval” analysis service, you match account transactions with the associated invoices and contracts. Our intelligent document retrieval not only recognizes transactions but also automatically assigns the correct invoice and contract documents to the account transactions.

Or you can learn more about your customer’s personal circumstances (e.g. marital status, children, living situation, etc.), liquidity, or the breakdown of monthly expenses across different categories such as food, clothing, mobility, vacations, and more. The analysis services provide you with valuable insights into your customer’s world – simply at the touch of a button.

We would be happy to advise you on the right analysis services for your use case!

One team, one passion

We know data

fino’s roots lie in the FinTech industry’s first digital and fully automated account switch.

Since it was founded in 2015, fino has grown steadily and has continuously developed its extensive portfolio of innovative products and services for the digitalization of the financial world.

We believe that the future belongs to data-driven business models. As experts in the field of account and data analytics, it is therefore our declared mission to give value to data and turn it into useful insights through intelligent and forward-looking data analytics solutions. Account transaction data in particular reflects the entire life of your customers – we help you to quickly and easily harness this data for your business model and thus create completely new perspectives!